Buying Physical Gold: Why You Should Invest in Physical Gold and How to Get Started

Buying physical gold may seem like a fossilized practice from a past long forgotten, but that is far from the case. Physical gold still has its uses, from generic gold bars, to gold coins and gold bullion and even solar technologies. It’s also a timeless investment that stands up against full economic crashes and recessions alike. Gold is also a safety net for the savvy investor looking to diversify.

Here are a few ways and reasons to buy physical gold.

Why Physical Gold?

While it’s true, there are more compact methods for buying gold, such as stocks or ETFs, purchasing physical gold still has its allure after centuries of admiration. But it’s also managed to retain something far greater than allure: it’s value. The price of gold may fluctuate over time, but it has always been the standard for investments in precious metals.

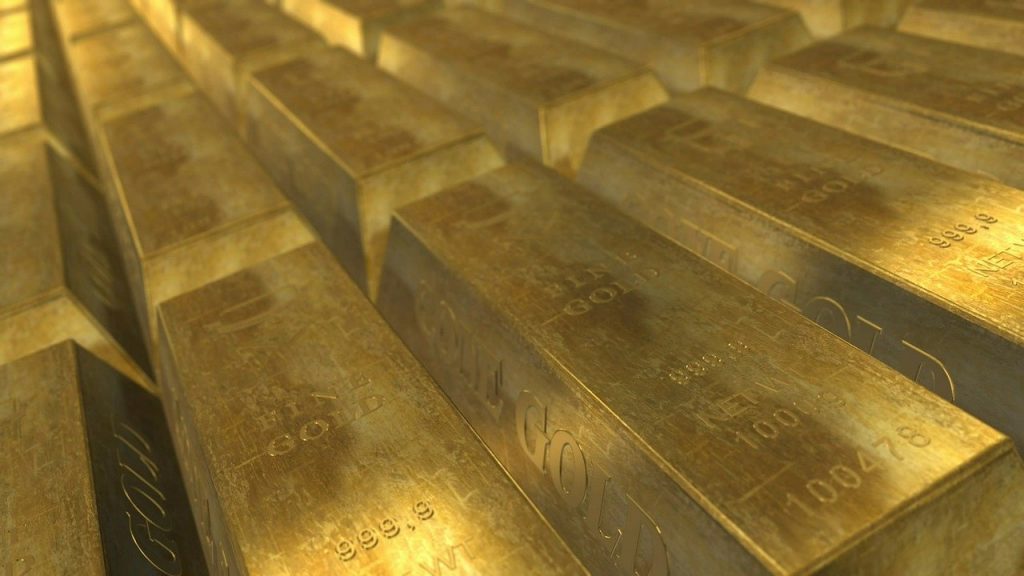

Physical gold comes in several different types,. You may opt for a traditional bar of gold or gold bullion with the purity rating stamped across the face. You might opt for more transportable gold coins commemorating a famous moment in history or with a simple yet stunning carved obverse. Regardless of the type of gold you decide to purchase, you can rest assured the metal will not only retain its value, but is easily passed down from generation to generation.

How to Buy Gold Bullion and Gold Coins

If you decide to buy gold bars or bullion coins, make sure you’re putting your time and trust in a dealer with credentials and accreditations. Finding a reputable seller is one of the best ways to ensure you’re getting a pure gold investment and not an unknown alloy or mix of other precious metals and less precious material.

Once you’ve found your dealer, it’s time to learn the ins and out of investing in the different types of physical gold available.

Gold Bullion

Gold bullion is often sold by the weight. These specific types of gold bars come shaped typically as a rectangle with the gold purity stamped on the face of the bullion bar. Gold bullion bars are easily accessible these days, with sales happening virtually more often than in a store. The first rule of purchasing gold bullion, however, is to ensure your seller is a reputable seller. The second is to ensure you’re purchasing the right amount and have the appropriate handling set up for after the purchase.

Gold Coins

Like gold bars, gold coins can also be purchased online from a reputable dealer. These coins are a great way to hold onto your gold in an easy and portable collector’s item. These coins are made from gold bars, tend to be at least .91 in purity and have brilliant artistic renderings such as the American Gold Eagle coins of the United States. Several other countries have their own versions of gold coins, which could still be traded internationally due to the value of physical gold being observed on a global level.

Whether you purchase gold bars or bullion coins, your investment in either will always hold gold’s value. Gold will always be a worthy investment, even across country borders. But if you’re going to invest heavily in gold, or start stocking up your collection, be sure your seller is always a reputable source to buy gold bars, coins or other physical gold pieces from.